Suze Orman’s Ultimate Retirement Guide: A Comprehensive Plan (2025 Edition)

Discover a revised and updated guide, reflecting recent Congressional changes, offering no-nonsense advice and practical tools for securing your financial future․

Download the 2025 edition completely FREE on PDFdrive․to – no registration or payment is needed for instant access!

Welcome to the 2025 edition of Suze Orman’s Ultimate Retirement Guide! This comprehensively revised resource is designed to empower individuals aged 50 and beyond to navigate the complexities of modern retirement planning․

This edition isn’t just an update; it’s a vital response to the evolving financial landscape, specifically incorporating recent changes to retirement rules passed by Congress․ Suze Orman, America’s trusted financial advisor, delivers her signature no-nonsense approach, providing actionable strategies and practical tools․

Whether you’re actively working towards retirement or already enjoying it, this guide offers the guidance needed to feel financially secure․ Find the complete PDF, legally and free, at PDFdrive․to – no registration required․ Prepare to take control of your future!

Who is Suze Orman and Why Trust Her Advice?

Suze Orman is widely recognized as America’s most trusted personal finance expert․ The New York Times has dubbed her “America’s favorite financial advisor,” while USA Today calls her a “one-woman financial advice powerhouse․” For years, she’s dispensed practical, actionable advice, helping countless individuals achieve financial security․

Her expertise stems from a deep understanding of the challenges people face, combined with a compassionate approach to financial planning․ The Ultimate Retirement Guide embodies this philosophy, offering a clear path to a secure future․

Trust Orman’s guidance, now updated for 2025, available as a free PDF on PDFdrive․to․ Her decades of wisdom are readily accessible!

Understanding the Core Principles

The 2025 guide delivers no-nonsense advice and practical tools, reflecting recent Congressional updates, to help you plan for a secure retirement․

The Importance of Financial Security in Retirement

Suze Orman’s 2025 Ultimate Retirement Guide emphasizes the critical need for financial security during your retirement years․ This guide isn’t just about accumulating wealth; it’s about ensuring that money lasts a lifetime, providing peace of mind and freedom․

The updated edition addresses the ever-changing financial landscape and recent Congressional rule changes, offering actionable strategies to navigate these complexities․ Orman’s approach focuses on practical tools and straightforward advice, empowering individuals to take control of their financial future․

The free PDF available on PDFdrive․to provides comprehensive guidance, helping you feel secure whether you are still working or already enjoying retirement․ It’s about winning strategies to make your money last․

No-Nonsense Retirement Planning Philosophy

Suze Orman’s Ultimate Retirement Guide (2025 Edition) delivers a refreshingly direct and practical approach to retirement planning․ She cuts through the complexity, offering clear, actionable steps rather than vague promises․ This philosophy is central to the guide, available as a free PDF on PDFdrive․to․

Orman’s no-nonsense style reflects a deep understanding of the anxieties surrounding retirement․ The updated guide incorporates recent Congressional changes, ensuring the advice remains relevant and effective․

It’s about taking ownership of your financial future, making informed decisions, and building a secure foundation for lasting financial freedom․ The PDF provides the tools needed to implement this philosophy․

Adapting to Changing Retirement Rules (Congress Updates)

The 2025 edition of Suze Orman’s Ultimate Retirement Guide, freely accessible as a PDF on PDFdrive․to, is crucial due to recent legislative shifts․ Congress has enacted changes impacting retirement planning, and this guide provides essential updates․

Orman expertly translates complex legal adjustments into understandable strategies․ These updates cover areas like Social Security, Medicare, and potential tax implications, ensuring your plan remains compliant and optimized․

Ignoring these changes could significantly jeopardize your retirement security․ The PDF offers a proactive approach, empowering you to adapt your strategy and maximize benefits in the evolving landscape of retirement rules․

Key Strategies for Ages 50+

The 2025 Ultimate Retirement Guide PDF provides actionable advice and tools for those 50+, helping you assess finances and plan wisely․

Assessing Your Current Financial Situation

Suze Orman’s Ultimate Retirement Guide (2025 PDF) emphasizes a thorough understanding of your present financial landscape․ This crucial first step involves honestly evaluating all assets – including retirement accounts, investments, and property – alongside liabilities like mortgages, loans, and debts․

The guide provides practical tools to calculate your net worth, offering a clear snapshot of your financial health․ It encourages a detailed review of income and expenses, identifying areas for potential savings and optimization․

Understanding where your money is going is paramount․ Orman’s approach isn’t about restriction, but about informed choices, empowering you to build a secure foundation for a comfortable retirement, as detailed within the downloadable PDF․

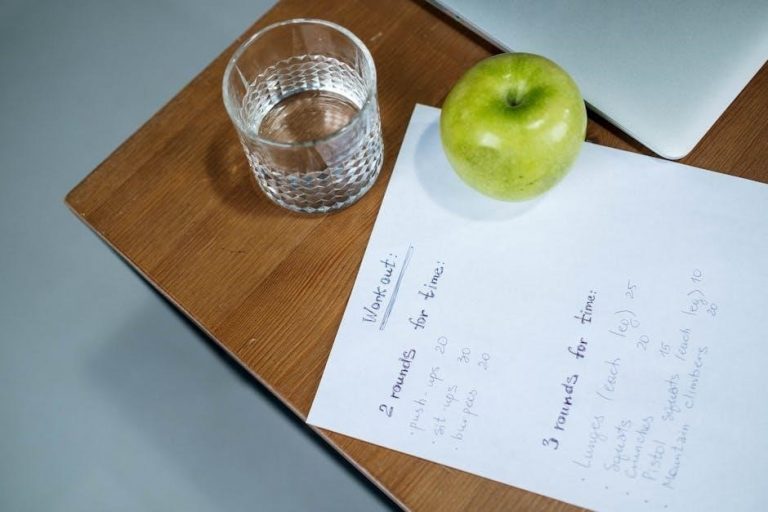

Creating a Realistic Retirement Budget

Suze Orman’s Ultimate Retirement Guide (2025 PDF) stresses the importance of a meticulously planned budget․ This isn’t simply about cutting expenses; it’s about forecasting future needs and aligning spending with your retirement income sources․

The guide advocates for distinguishing between “needs” and “wants,” prioritizing essential expenses like healthcare and housing․ It encourages projecting future costs, accounting for inflation and potential unexpected events․

Orman’s approach, detailed in the downloadable PDF, emphasizes creating multiple budget scenarios – optimistic, realistic, and conservative – to prepare for various market conditions․ A realistic budget is the cornerstone of a secure and stress-free retirement․

Maximizing Social Security Benefits

Suze Orman’s Ultimate Retirement Guide (2025 PDF) dedicates significant attention to strategically claiming Social Security benefits․ She emphasizes that the timing of your claim dramatically impacts your lifetime payout․

The guide details the pros and cons of claiming benefits at age 62, full retirement age, and age 70, highlighting how delaying benefits can result in a substantially larger monthly income․

Orman’s PDF resource also explores spousal and survivor benefits, offering strategies for couples to maximize their combined income․ Understanding these nuances, as outlined in the guide, is crucial for a financially secure retirement․

Understanding Medicare and Healthcare Costs

Suze Orman’s Ultimate Retirement Guide (2025 PDF) stresses the importance of proactive Medicare planning․ The guide breaks down the complexities of Parts A, B, C, and D, helping retirees navigate enrollment periods and coverage options․

Orman’s resource details supplemental insurance options like Medigap and Medicare Advantage plans, advising readers on choosing the best fit for their healthcare needs and budget․

The PDF also addresses often-overlooked healthcare costs in retirement, such as long-term care and prescription drug expenses, offering strategies for financial preparedness․

Investment Strategies for Longevity

The 2025 Ultimate Retirement Guide PDF details asset allocation, exploring stocks, bonds, and mutual funds to generate income and protect your portfolio․

Asset Allocation for Retirement Income

Suze Orman’s 2025 Ultimate Retirement Guide, available as a free PDF on platforms like PDFdrive․to, emphasizes a strategic approach to asset allocation․ This involves carefully dividing your investments among different asset classes – stocks, bonds, and mutual funds – to balance risk and potential returns․

The guide doesn’t advocate a one-size-fits-all solution; instead, it stresses tailoring your allocation to your individual circumstances, risk tolerance, and time horizon․ Orman’s advice focuses on creating a portfolio designed to generate a sustainable income stream throughout your retirement years, while also protecting your capital from market volatility․

The PDF provides practical tools and insights to help you determine the optimal mix of assets for your specific needs, ensuring a more secure and comfortable retirement;

The Role of Stocks, Bonds, and Mutual Funds

Suze Orman’s Ultimate Retirement Guide (2025 Edition), accessible as a free PDF, details the crucial roles of stocks, bonds, and mutual funds in a retirement portfolio․ The guide, found on resources like PDFdrive․to, explains how stocks offer growth potential but carry higher risk, while bonds provide stability and income․

Orman emphasizes that mutual funds can offer diversification, reducing risk by spreading investments across various assets․ She advocates for understanding the expense ratios and investment objectives of each fund before investing․

The PDF provides guidance on strategically combining these asset classes to create a balanced portfolio aligned with your risk tolerance and retirement goals, ensuring a sustainable income stream․

Avoiding Common Investment Mistakes

Suze Orman’s Ultimate Retirement Guide (2025 Edition), available as a free PDF, highlights critical investment pitfalls to avoid․ The guide, readily downloadable from sites like PDFdrive․to, stresses the dangers of emotional investing – making decisions based on fear or greed․

Orman warns against chasing “hot” stocks or market timing, advocating for a long-term, disciplined approach․ She emphasizes the importance of diversification to mitigate risk and avoiding high-fee investments that erode returns․

The PDF details how to recognize and sidestep these common errors, empowering readers to protect their retirement savings and build a secure financial future, as per her no-nonsense advice․

Protecting Your Portfolio from Market Volatility

Suze Orman’s Ultimate Retirement Guide (2025 Edition), accessible as a free PDF, provides strategies to shield your investments during turbulent times․ Downloadable from resources like PDFdrive․to, the guide emphasizes the necessity of a well-diversified portfolio, spreading risk across various asset classes․

Orman advocates for understanding your risk tolerance and adjusting your asset allocation accordingly․ She stresses the importance of not panicking during market downturns and avoiding impulsive selling․

The PDF details techniques like dollar-cost averaging and rebalancing to navigate volatility, ensuring long-term financial security, aligning with her practical, no-nonsense approach to retirement planning․

Making Your Money Last a Lifetime

The 2025 Ultimate Retirement Guide PDF details winning strategies for lifetime financial security, including withdrawal tactics and tax-efficient income planning․

Download from PDFdrive․to!

Withdrawal Strategies in Retirement

Suze Orman’s 2025 Ultimate Retirement Guide, available as a free PDF on PDFdrive․to, dives deep into crucial withdrawal strategies to ensure your funds endure․ The guide explores the widely known 4% rule, offering both its benefits and potential drawbacks in today’s economic climate․

More importantly, Orman presents viable alternatives tailored to diverse financial situations and risk tolerances․ She emphasizes the importance of a personalized approach, moving beyond rigid rules to create a sustainable income stream throughout retirement․ The PDF provides practical tools and calculations to help you determine the optimal withdrawal rate for your specific needs, maximizing longevity and peace of mind․

Understand how to navigate taxes and minimize their impact on your withdrawals, preserving more of your hard-earned savings․

The 4% Rule and Its Alternatives

Suze Orman’s Ultimate Retirement Guide (2025 Edition), freely accessible as a PDF on PDFdrive․to, thoroughly examines the 4% rule – a long-standing guideline for safe retirement withdrawals․ However, Orman doesn’t simply endorse it; she critically analyzes its limitations in the current economic landscape․

The guide details how factors like prolonged low-interest rates and increased market volatility can challenge the 4% rule’s effectiveness․ Orman then presents several compelling alternatives, including dynamic withdrawal strategies that adjust based on market performance and individual circumstances․

Learn how to tailor your withdrawal rate to your specific risk tolerance and longevity expectations, ensuring a secure and sustainable retirement income stream․

Tax-Efficient Retirement Income Planning

Suze Orman’s Ultimate Retirement Guide (2025 Edition), available as a free PDF on PDFdrive․to, emphasizes minimizing taxes throughout retirement․ Orman stresses the importance of understanding the tax implications of various income sources – Social Security, pensions, and investment withdrawals․

The guide details strategies for strategically sequencing withdrawals from different account types (taxable, tax-deferred, and tax-free) to reduce your overall tax burden․ Learn how to leverage Roth conversions and qualified charitable distributions․

Orman provides practical advice on tax-loss harvesting and other techniques to maximize after-tax income, ensuring more of your hard-earned money stays in your pocket during retirement․

Specific Considerations for Different Scenarios

The 2025 Ultimate Retirement Guide PDF, found on PDFdrive․to, addresses unique planning needs for singles, couples, and those considering early retirement options․

Retirement Planning for Single Individuals

Suze Orman’s Ultimate Retirement Guide (2025 edition), available as a free PDF on PDFdrive․to, provides crucial guidance for those navigating retirement solo․ It emphasizes the heightened importance of self-reliance and proactive financial planning when lacking a partner’s support․

The guide stresses building a robust financial foundation, maximizing Social Security benefits, and carefully considering healthcare costs – all vital for single retirees․ It offers strategies for creating a realistic budget and avoiding common investment pitfalls, ensuring financial security without a dual income․

Specifically, the PDF details how to build an emergency fund, plan for long-term care, and establish a clear estate plan, addressing unique challenges faced by single individuals approaching or already in retirement․

Retirement Planning for Couples

Suze Orman’s Ultimate Retirement Guide (2025 edition), freely accessible as a PDF on PDFdrive․to, offers tailored advice for couples planning their financial future together․ It highlights the necessity of open communication and collaborative decision-making regarding shared financial goals․

The guide emphasizes coordinating Social Security strategies to maximize benefits for both partners, and navigating Medicare options as a unit․ It provides tools for creating a joint budget, aligning investment strategies, and planning for potential long-term care expenses․

The PDF specifically addresses how to handle differing risk tolerances, plan for potential income gaps, and establish a comprehensive estate plan that protects both individuals and their shared assets․

Early Retirement Options and Challenges

Suze Orman’s Ultimate Retirement Guide (2025 edition), available as a free PDF on PDFdrive․to, directly addresses the complexities of retiring before the traditional age․ It acknowledges the appeal of early retirement while outlining the significant financial hurdles involved․

The guide stresses the importance of meticulous planning, including accurately estimating extended healthcare costs and ensuring sufficient savings to cover a potentially longer retirement period․ The PDF details strategies for bridging the gap between retirement and Social Security eligibility․

It also cautions against underestimating the impact of inflation and market volatility, and provides guidance on creating a sustainable withdrawal strategy to avoid depleting funds prematurely․

Accessing the Ultimate Retirement Guide PDF

Secure your financial future! Download Suze Orman’s 2025 Ultimate Retirement Guide in PDF format, completely free, from PDFdrive․to today!

Where to Download the PDF Legally and Free

Finding a legitimate and free source for Suze Orman’s Ultimate Retirement Guide (2025 Edition) PDF is crucial․ PDFdrive․to is presented as a resource offering instant access without requiring registration or payment․ This platform allows you to download the guide directly, providing a convenient way to obtain this valuable financial planning tool․

However, always exercise caution when downloading from any online source․ Ensure the file is the latest 2025 edition to benefit from the most current advice, including updates reflecting recent changes in retirement rules passed by Congress․ Prioritize legal and reputable platforms to avoid potential security risks or outdated information․ This guide empowers you with the knowledge to achieve financial security․

PDFdrive․to as a Resource

PDFdrive․to emerges as a readily accessible platform for obtaining Suze Orman’s Ultimate Retirement Guide for 50 (2025 Edition) in PDF format․ The site boasts a user-friendly experience, eliminating the need for cumbersome registration processes or financial transactions – offering completely free access to this valuable resource․

This makes it a convenient option for individuals seeking immediate access to Orman’s expert advice․ However, users should remain vigilant, verifying the file’s authenticity and ensuring it corresponds to the latest 2025 edition․ PDFdrive․to provides a direct pathway to potentially securing your financial future, but responsible downloading practices are essential․

Ensuring the PDF is the Latest 2025 Edition

Confirming you have the most current 2025 edition of Suze Orman’s Ultimate Retirement Guide is crucial, as retirement rules are subject to change, particularly with recent Congressional updates․ Carefully examine the document’s publication date and any accompanying details to verify its relevance․

Look for explicit mentions of the “2025 Edition” on the cover and within the introductory sections․ Outdated information could lead to flawed financial planning․ Prioritize downloading from reputable sources like PDFdrive․to, but always double-check the file details to guarantee you’re utilizing the latest, most accurate guidance available from Suze Orman․

Beyond the Book: Additional Resources

Explore Suze Orman’s website for further publications and utilize available financial planning tools and calculators to enhance your retirement strategy․

Suze Orman’s Website and Other Publications

Dive deeper into Suze Orman’s wealth of financial knowledge by visiting her official website․ There, you’ll find a treasure trove of articles, insights, and resources designed to empower you on your financial journey․ Orman, frequently recognized as America’s favorite financial advisor by publications like The New York Times, consistently delivers actionable advice․

Beyond the Ultimate Retirement Guide, explore her other publications and appearances․ She’s a “one-woman financial advice powerhouse” (USA Today), offering diverse perspectives on securing your financial future․ Her commitment to financial literacy extends beyond books, encompassing various platforms to reach a wider audience and provide ongoing support․

Financial Planning Tools and Calculators

Complementing the Ultimate Retirement Guide, numerous online tools and calculators can refine your personalized plan․ These resources assist in accurately assessing your current financial standing and projecting future needs, crucial steps highlighted within the guide itself․

Utilize these tools to model different scenarios, such as varying withdrawal rates or healthcare cost projections, ensuring your strategy remains robust․ Suze Orman emphasizes the importance of proactive planning, and these digital aids empower you to take control․ Remember, the PDF guide provides the foundational knowledge, while these tools offer practical application and enhanced precision in your retirement calculations․