Mozambique State Budget 2024: A Comprehensive Overview (PDF Focus)

The Mozambican parliament commenced its first ordinary session of the legislature on Wednesday, focusing on the State Budget proposal for 2024, available in PDF format.

The 2024 Mozambique State Budget represents a critical juncture for the nation’s economic trajectory, outlining the government’s financial plan for the upcoming year. This budget, formally presented to and currently under discussion within the Mozambican parliament – which initiated its first ordinary session on Wednesday – details proposed allocations across various sectors, aiming to foster sustainable growth and address key socio-economic challenges.

A central element of this process is the comprehensive PDF document containing the full budget proposal. This document serves as the primary reference point for legislators, economists, civil society organizations, and the public seeking detailed insights into the government’s fiscal strategy. Understanding the intricacies within this PDF is crucial for evaluating the budget’s potential impact on Mozambique’s development.

The parliamentary session’s initial focus includes the election of members to the Council of State alongside the detailed scrutiny of this proposed budget. Access to and analysis of the 2024 State Budget PDF will be paramount in assessing its alignment with national priorities and its feasibility given the prevailing economic climate.

Context: Mozambique’s Economic Situation in 2023

Understanding Mozambique’s economic landscape in 2023 is vital for interpreting the priorities reflected in the 2024 State Budget, detailed within its official PDF document. The nation navigated a complex year marked by both opportunities and significant hurdles, influencing the financial planning for the subsequent fiscal period.

While specific economic data requires deeper analysis of reports accompanying the budget PDF, it’s understood that Mozambique faced challenges related to debt sustainability, inflationary pressures, and the impact of global economic shifts. These factors directly shaped the government’s approach to revenue generation and expenditure allocation, as outlined in the proposed budget.

The current parliamentary session, which began on Wednesday with discussions surrounding the 2024 budget PDF, is taking place against this backdrop. Legislators are tasked with evaluating the budget’s responsiveness to the economic realities of 2023 and its potential to mitigate existing vulnerabilities while fostering inclusive and sustainable growth. The PDF document provides the necessary financial details for this critical assessment.

Key Economic Indicators Influencing the 2024 Budget

Several key economic indicators heavily influenced the formulation of Mozambique’s 2024 State Budget, comprehensively detailed within the official PDF document. These indicators served as the foundation for revenue projections and expenditure priorities, shaping the nation’s financial roadmap for the coming year.

The parliamentary discussions, initiated this Wednesday, center around understanding how these indicators were factored into the budget proposal. Crucial elements include the performance of key sectors like agriculture and natural resources, particularly gas and minerals, as reflected in the PDF’s revenue estimates. Global commodity prices and their impact on Mozambique’s export earnings are also central.

Furthermore, debt levels, exchange rate fluctuations (Metical vs. USD), and prevailing inflation rates played a significant role. The 2024 budget PDF outlines the government’s strategies to manage these challenges. Analyzing these indicators within the document is essential for a thorough understanding of the budget’s underlying assumptions and potential risks.

GDP Growth Projections

The 2024 Mozambique State Budget, accessible as a detailed PDF document, hinges on specific Gross Domestic Product (GDP) growth projections. These projections are fundamental to revenue forecasting and underpin the government’s planned expenditures for the fiscal year.

Currently, the parliamentary session, beginning this Wednesday, is dedicated to scrutinizing these projections and their feasibility. The budget PDF likely outlines anticipated growth rates across various sectors, including agriculture, mining (particularly gas), and tourism. These figures are influenced by both domestic policies and external factors, such as global economic conditions and commodity prices.

A careful review of the PDF reveals the assumptions driving these projections – investment levels, consumption patterns, and export performance. Understanding these assumptions is crucial for assessing the budget’s overall credibility and potential impact on Mozambique’s economic trajectory. The document details how achieving these growth targets will contribute to poverty reduction and sustainable development.

Inflation Rates and Monetary Policy

The 2024 Mozambique State Budget, detailed within its comprehensive PDF format, directly addresses anticipated inflation rates and the corresponding monetary policy responses. Controlling inflation is paramount for maintaining economic stability and protecting purchasing power.

The budget PDF likely outlines the government’s inflation targets for the year, alongside strategies to achieve them. These strategies are closely linked to the central bank’s monetary policy tools, such as interest rate adjustments and reserve requirements. The parliamentary discussions, initiated this Wednesday, will focus on evaluating the realism of these targets.

Factors influencing inflation, as detailed in the document, include exchange rate fluctuations, global commodity prices, and domestic supply-side constraints. The PDF will also clarify how the government intends to mitigate inflationary pressures, potentially through fiscal measures and improved supply chain management. A thorough analysis reveals the interplay between fiscal and monetary policies in achieving macroeconomic stability.

Exchange Rate Dynamics (Metical vs. USD)

The 2024 Mozambique State Budget, accessible in its full PDF version, keenly observes the dynamics between the Metical and the US Dollar, recognizing its crucial impact on the national economy. Exchange rate stability is vital for managing external debt, controlling inflation, and fostering international trade.

The budget document likely projects the anticipated exchange rate path for the coming year, factoring in variables like foreign exchange reserves, balance of payments, and global economic conditions. The parliamentary session, beginning this Wednesday, will scrutinize these projections for accuracy and potential risks.

Fluctuations in the Metical/USD rate directly affect import costs, debt servicing obligations, and the competitiveness of Mozambican exports. The PDF will detail government strategies to manage exchange rate volatility, potentially through interventions in the foreign exchange market or prudent monetary policy. Understanding these dynamics is essential for assessing the budget’s overall viability and resilience.

Budgetary Priorities for 2024

The 2024 Mozambique State Budget, currently under parliamentary review and available as a comprehensive PDF document, outlines the government’s key spending priorities for the upcoming fiscal year. This session, commencing Wednesday, will focus on allocating resources to areas deemed critical for sustainable development and economic growth.

The budget’s priorities likely reflect a commitment to infrastructure development, aiming to improve transportation networks, energy access, and overall connectivity. Significant allocations are also anticipated for social sector investments, particularly in health and education, to enhance human capital and improve living standards.

Furthermore, the PDF document will detail planned investments in agricultural development and food security initiatives, crucial for a nation heavily reliant on agriculture. The parliamentary debate will center on ensuring these priorities are adequately funded and aligned with Mozambique’s long-term development goals, as detailed within the budget’s framework.

Infrastructure Development

The 2024 Mozambique State Budget, accessible in PDF format following parliamentary review, designates a substantial portion of resources towards bolstering the nation’s infrastructure. This focus stems from a recognized need to improve connectivity and facilitate economic expansion across various sectors.

Key areas of investment, as detailed within the budget document, likely include road construction and rehabilitation, aiming to reduce transportation costs and improve access to markets. Expansion of energy infrastructure, particularly renewable energy sources, is also anticipated, addressing Mozambique’s growing energy demands.

Furthermore, the budget may allocate funds for port modernization and expansion, crucial for handling increased trade volumes. Investments in telecommunications infrastructure are also probable, aiming to bridge the digital divide and enhance access to information and communication technologies. The parliamentary session will scrutinize these allocations to ensure efficient and effective implementation.

Social Sector Investments (Health, Education)

The 2024 Mozambique State Budget, currently under parliamentary consideration and available as a PDF document, prioritizes significant investments in the social sectors – specifically health and education. This commitment reflects the government’s dedication to improving human capital and fostering inclusive growth.

Within the health sector, allocations likely target strengthening primary healthcare services, improving access to essential medicines, and combating prevalent diseases. Investments in healthcare infrastructure, including hospitals and clinics, are also anticipated. The education budget is expected to focus on expanding access to quality education at all levels, from primary to tertiary.

Key areas of focus may include teacher training and recruitment, provision of learning materials, and infrastructure development for schools. The parliamentary debate surrounding the budget will assess whether these allocations are sufficient to address the pressing needs and achieve desired outcomes in health and education.

Agricultural Development and Food Security

The 2024 Mozambique State Budget, presently under review by parliament and accessible in PDF format, designates crucial funding for agricultural development and bolstering national food security. Recognizing agriculture as a cornerstone of the Mozambican economy and a vital source of livelihood for a significant portion of the population, the budget aims to enhance productivity and resilience within the sector.

Allocations are anticipated to support initiatives promoting improved farming techniques, access to agricultural inputs like fertilizers and seeds, and irrigation infrastructure development. Investments in agricultural research and extension services are also expected, fostering innovation and knowledge transfer to farmers.

Furthermore, the budget likely incorporates measures to strengthen value chains, improve market access for agricultural products, and mitigate the impacts of climate change on agricultural production. The parliamentary discussion will scrutinize whether these provisions adequately address the challenges and opportunities within Mozambique’s agricultural landscape.

Revenue Projections for 2024

The 2024 Mozambique State Budget, currently debated in parliament and detailed within the official PDF document, hinges on ambitious revenue projections. These projections are fundamental to funding the government’s planned expenditures and achieving its economic objectives for the year. A significant portion of anticipated revenue is expected to stem from tax collection, encompassing various forms of direct and indirect taxation across different economic sectors.

Crucially, revenue derived from Mozambique’s burgeoning natural resource sector – particularly liquefied natural gas (LNG) and mineral exports – plays an increasingly important role. The budget’s success is heavily reliant on sustained high global commodity prices and consistent production levels.

Furthermore, the government anticipates receiving substantial external aid and grants from international partners. The parliamentary review will assess the realism of these revenue forecasts, considering potential economic headwinds and global market volatility, as outlined in the budget PDF.

Tax Revenue Estimates

The 2024 Mozambique State Budget, accessible in its complete PDF form, places considerable emphasis on bolstering tax revenue collection. Estimates indicate a projected increase in tax income compared to the previous fiscal year, driven by anticipated economic growth and improved tax administration efficiency. Value Added Tax (VAT) remains a cornerstone of tax revenue, alongside corporate income tax levied on businesses operating within Mozambique.

Personal income tax contributions are also expected to rise, reflecting a formalization of the labor market and potential wage increases. The budget PDF details specific targets for each tax category, outlining strategies to minimize tax evasion and enhance compliance.

Furthermore, the government intends to streamline tax procedures and leverage digital technologies to improve revenue collection processes. Successful achievement of these tax revenue estimates is critical for financing key public services and infrastructure projects, as detailed within the official document.

Revenue from Natural Resources (Gas, Minerals)

The 2024 Mozambique State Budget PDF highlights the increasing importance of revenue generated from the country’s abundant natural resources, particularly natural gas and minerals. Significant revenue projections are linked to ongoing and upcoming gas projects, representing a substantial contribution to the national treasury. These earnings are expected to fund critical development initiatives outlined within the budget document.

Mineral exports, including coal and other valuable resources, also contribute significantly to revenue streams. The budget details anticipated royalties and taxes derived from these extractive industries, emphasizing responsible resource management.

However, the PDF acknowledges potential volatility in commodity prices and emphasizes the need for prudent fiscal planning. The government intends to establish a sovereign wealth fund to manage resource revenues effectively and ensure long-term economic stability, as detailed in the comprehensive budget report.

External Aid and Grants

The 2024 Mozambique State Budget PDF demonstrates a continued reliance on external aid and grants to supplement domestic revenue sources. These funds, provided by international partners and development agencies, are crucial for supporting key sectors like health, education, and infrastructure development, as detailed within the document.

The budget outlines specific allocations for grant-funded projects, emphasizing transparency and accountability in the utilization of these resources. A significant portion of external assistance is directed towards poverty reduction programs and humanitarian aid, addressing pressing social needs.

The PDF also acknowledges the importance of strengthening partnerships with donor countries and organizations to ensure a sustainable flow of aid. The government is committed to aligning aid priorities with national development goals, maximizing the impact of external support on Mozambique’s economic growth and social progress;

Expenditure Allocations in the 2024 Budget

The 2024 Mozambique State Budget PDF reveals a strategic allocation of expenditures, prioritizing key sectors for national development. A substantial portion is dedicated to public sector salaries and pensions, reflecting the government’s commitment to its workforce and retired citizens, as detailed within the document’s tables.

Significant funds are also earmarked for debt service obligations, a crucial aspect of fiscal management. Infrastructure development receives considerable investment, focusing on transportation, energy, and water resources to stimulate economic growth. The PDF highlights investments in social sectors, including health and education, aiming to improve access to essential services.

Furthermore, the budget allocates resources to agricultural development and food security initiatives, recognizing the importance of this sector for livelihoods and national stability. The document provides a comprehensive breakdown of expenditure by ministry and program, ensuring transparency and accountability.

Public Sector Salaries and Pensions

The 2024 Mozambique State Budget PDF demonstrates a significant commitment to public sector employees and retirees through substantial allocations for salaries and pensions. This represents a considerable portion of overall government expenditure, reflecting the importance placed on maintaining a motivated and stable public workforce, as detailed within the budget’s expenditure tables.

The PDF outlines specific provisions for salary adjustments, aiming to mitigate the impact of inflation and improve living standards for civil servants. Pension payments are also prioritized, ensuring financial security for retired public sector workers. The budget document provides a detailed breakdown of these allocations by ministry and category of employee.

These allocations are crucial for sustaining public services and maintaining social stability. The PDF’s transparency regarding these expenditures underscores the government’s commitment to responsible fiscal management and accountability to its citizens.

Debt Service Obligations

The 2024 Mozambique State Budget PDF reveals a substantial allocation dedicated to servicing the nation’s public debt, a critical component of fiscal planning. This portion of the budget reflects Mozambique’s ongoing commitment to meeting its financial obligations to both domestic and international creditors, as meticulously detailed within the document’s financial statements.

The PDF provides a comprehensive breakdown of debt service payments, categorized by creditor and type of debt instrument. It highlights the government’s strategy for managing its debt portfolio, including refinancing options and efforts to secure favorable repayment terms. These obligations significantly impact the availability of funds for other crucial sectors.

Transparent reporting on debt service within the PDF is essential for maintaining investor confidence and ensuring macroeconomic stability. The budget demonstrates a commitment to responsible debt management, balancing repayment needs with the country’s development priorities.

Accessing the 2024 State Budget PDF Document

The official 2024 Mozambique State Budget document, presented in PDF format, is a crucial resource for understanding the nation’s financial plan. Accessing this document is paramount for researchers, investors, and citizens seeking detailed insights into government spending and revenue projections. Initial reports indicate the document became available following parliamentary discussions commencing on Wednesday, marking the start of the legislative session.

Typically, the PDF is published on the official website of the Ministry of Economy and Finance of Mozambique. Direct links are often shared through official government press releases and news outlets. A thorough search using keywords like “Orçamento do Estado 2024 PDF” will yield the most current results.

Users should ensure they are downloading the document from a secure and official source to avoid potential security risks. The PDF contains extensive financial data and is a key instrument for transparency and accountability.

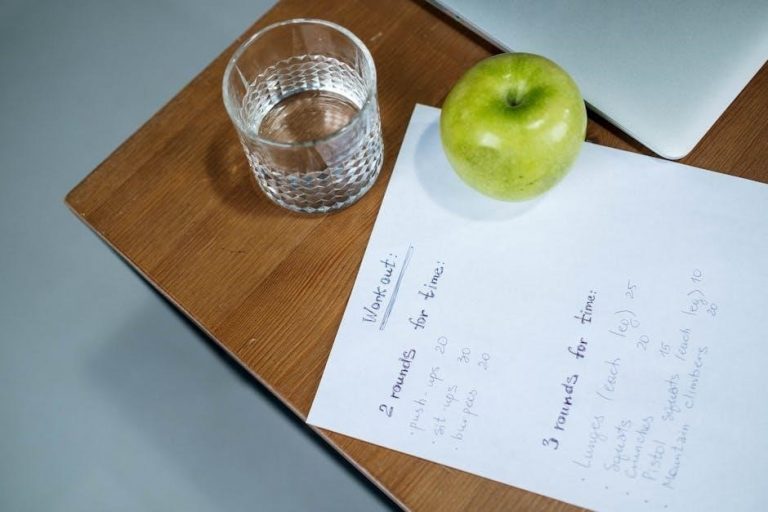

Analyzing the 2024 Budget PDF: Key Sections

A comprehensive analysis of the 2024 Mozambique State Budget PDF requires a focused approach to its key sections. The document, stemming from discussions initiated in parliament this Wednesday, typically begins with an overview of macroeconomic assumptions underpinning the budget – crucial for understanding the context.

Subsequent sections detail revenue projections, broken down by tax sources (VAT, corporate income tax) and revenue from natural resources like gas and minerals. Equally important is the expenditure allocation, categorized by sector: infrastructure, social programs (health, education), and debt service.

Pay close attention to sections outlining public sector salaries and pensions, as these significantly impact overall spending. The PDF also includes detailed tables and annexes providing granular data. Understanding these components is vital for assessing the budget’s feasibility and potential impact on Mozambique’s economic trajectory.

Potential Challenges and Risks to Budget Implementation

Successfully implementing the 2024 Mozambique State Budget, as detailed in the PDF document debated in parliament this week, faces several potential challenges. Global economic headwinds, including fluctuating commodity prices (particularly for gas), pose a significant risk to revenue projections.

Domestic risks include potential delays in finalizing large infrastructure projects, impacting capital expenditure. Furthermore, security concerns in certain regions could disrupt economic activity and affect budget execution. The accuracy of revenue forecasts, especially from the natural resource sector, is crucial; overestimation could lead to fiscal imbalances.

Effective budget management and transparency are also vital. Political stability and efficient public administration are essential for mitigating these risks and ensuring the budget achieves its intended objectives, as outlined within the comprehensive PDF.